Payroll is a very critical function for every business unit, and ensuring precise tax deductions is paramount. Sometimes, however, you might find QuickBooks payroll not deducting taxes, which can interrupt your whole payroll operations.

This can lead to issues such as non-compliance with tax laws, delayed or partial payment of tax dues, financial penalties, and increased employee dissatisfaction. However, there’s nothing to worry about, as this guide will help you quickly resolve this through accurate and simple solutions.

Alright then, let’s dive into this guide to learn why QuickBooks doesn’t automatically deduct payroll taxes and explore effective troubleshooting methods to fix it.

Why Payroll Taxes Suddenly Not Deducted in QuickBooks?

Here is the comprehensive list of reasons why QuickBooks payroll not deducting taxes:

- Using an obsolete QuickBooks Desktop application will cause compatibility issues with Windows, and thus, several errors will occur.

- An imprecise setup of payroll items and employee taxes will surely trigger faults when creating paychecks & calculating payroll taxes.

- The employee’s total earnings might be too low to deduct taxes.

- Damaged company data is another major reason that can cause difficulties when running QuickBooks payroll.

- The employee’s wages might have surpassed the wage base limit for the relevant tax.

- If you haven’t yet downloaded & installed payroll tax table updates, you are likely to experience issues when creating paychecks.

- Duplicate payroll tax items can lead to under-deduction or over-deduction of payroll taxes, potentially provoking various challenges.

- The imperfect tax withholding setup for different employees will cause errors when managing payroll tax calculations.

Now, let’s proceed to the following section to learn some reliable and quick solutions for this problem. This is important if you do not want to file wrong taxes or incorrect W2 forms.

What Should You Do If Payroll Not Deducting Taxes in QB Desktop?

Before we explore comprehensive techniques to fix this issue, let’s take a look at some really fast solutions in the following table. Implement these troubleshooting hacks and ensure the proper deduction of payroll taxes.

| Common Causes | Appropriate Solutions |

| Inaccurate employee’s payroll information | Recreate the paychecks |

| Invalid payroll tax item settings | Review all payroll items and include relevant modifications |

| Outdated QB Desktop | Download new QB updates |

| Faulty company data | Run the verify and rebuild data tool |

| Obsolete payroll tax tables | Install the latest payroll tax tables |

| Discrepancies in payroll tax liabilities | Adjust your payroll tax liabilities |

Let’s now go to the next section to learn detailed troubleshooting methods for this issue.

9 Hacks to Try When QuickBooks Payroll Not Deducting Taxes

When you find QuickBooks payroll not deducting taxes, carry out the solutions listed below. This will help you fix it.

1. Download and Install QB Desktop Updates

The first appropriate tactic is to install the latest QuickBooks Desktop updates. The new software updates always include improved features and better tools. You should try calculating payroll taxes once you have installed QB updates. Additionally, if you notice the QB data loss after an update, you should fix it instantly.

If, however, QB payroll is still not deducting taxes, try the following resolution.

2. Install Payroll Tax Table Updates

You can ensure precise payroll tax management by installing fresh payroll tax tables. Here’s how to do so:

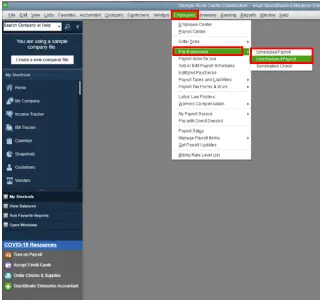

- Open QB Desktop, after which you need to select Employees promptly.

- Now, immediately choose the Get Payroll Updates tab.

- At this point, choose the Download Entire Update option, after which you should click Update.

- You should now allow the full installation of payroll tax table updates. At times, you might find QuickBooks payroll updates not working, so you will need to resolve that first.

- Finally, QB payroll will swiftly calculate all the taxes.

Is QuickBooks payroll not deducting taxes even now? If that’s the case, consider refreshing the employee’s payroll information, as discussed below.

3. Reload Your Employee’s Payroll Data

Imprecise tax rates and deductions often prevent the calculation of taxes through QB payroll. To fix this, you need to refresh your employee’s payroll data as explained below:

(a) When You Have Yet to Issue the Paycheck

If you haven’t finally generated the paycheck, consider reverting it through the following steps:

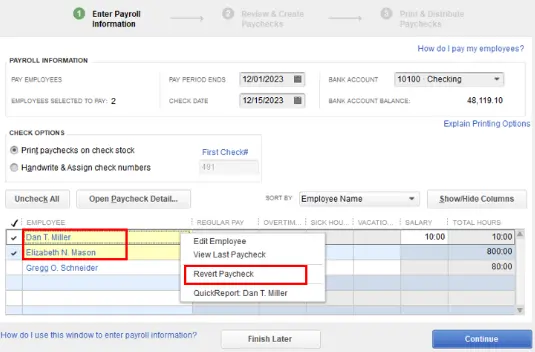

- Access your QB application window to choose Employees.

- Now, you need to select Pay Employees, after which you should click Scheduled Payroll.

- Tap Resume Scheduled Payroll and quickly right-click the employee’s name.

- Click the Revert Paychecks button to refresh the payroll information instantly.

- You can now easily calculate taxes using QB payroll.

(b) When You Have Already Generated the Paycheck

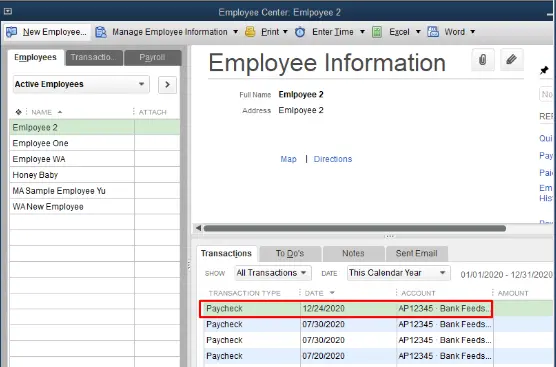

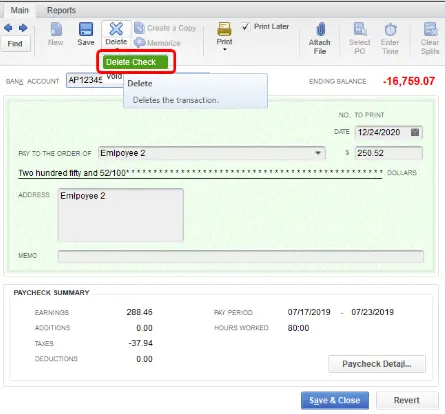

You should delete the paycheck if you have already issued it. Here’s how to do so:

- Swiftly open the QB Desktop window to choose Banking.

- Next, choose the Use Register tab, after which you should identify your bank account.

- Once you have selected your bank account, click OK.

- At this point, access the relevant paycheck and tap Delete.

- Finally, tap OK to erase the paycheck. You can now recreate the paycheck with proper tax details.

If you find QuickBooks payroll not deducting taxes even now, consider reviewing the employee’s tax withholding setup as mentioned below.

4. Check the Employee’s Tax Withholding Setup

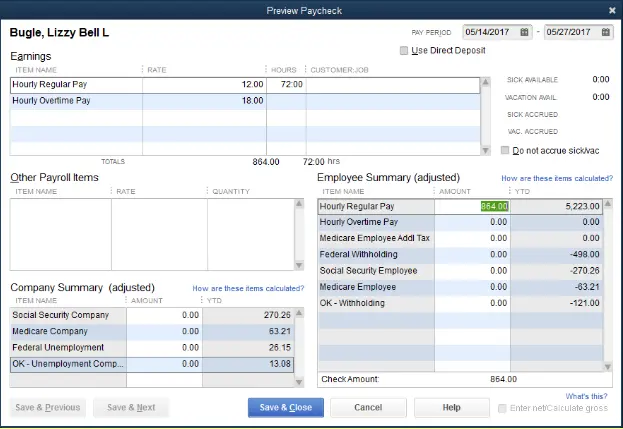

The taxes can show up as $0.00 on the paycheck if the employee claims an exemption or if the employee’s wages are too low. You can find the minimum threshold for tax deduction in the IRS publication and the respective state tax department websites.

If you determine that the employee should not have tax exemptions, you can modify the tax filing status. Here’s how to do so:

- Access QB and choose Employees, after which you need to click Employee Center.

- Choose the employee’s name and tap Payroll Info.

- At this point, select Taxes and navigate to the Federal tab.

- Use the W-4 dropdown to select the relevant form.

- Set the Filing Status as Not Exempt and move to the State tab.

- At this point, quickly choose Not Exempt using the Filing Status tab.

- Tap OK, and you will be able to deduct taxes using QB payroll for the employee.

Is QuickBooks payroll not deducting taxes despite checking the tax withholding setup? If so, try reviewing the payroll item setup as described below.

5. Check the Payroll Item Configuration When Payroll Not Deducting Taxes

An invalid payroll item setup can trigger discrepancies in the employee’s paycheck when taxes are calculated. You should review the entire payroll item setup to ensure precise tax deductions. Here’s how to do so:

Step I: Run the Payroll Detail Review Report

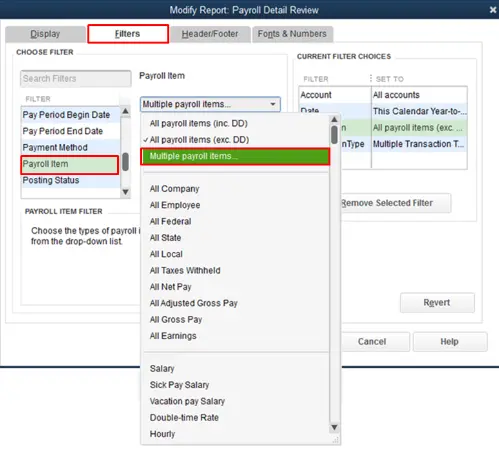

The Payroll Detail Review report can help you check the validity of the tax deductions on the paycheck. Here’s how to run the report:

- Access the Reports menu in QB Desktop and choose Employees & Payroll.

- Click Payroll Detail Review and tap Customize Report.

- Go to the Display tab and choose the date range using the From and To options.

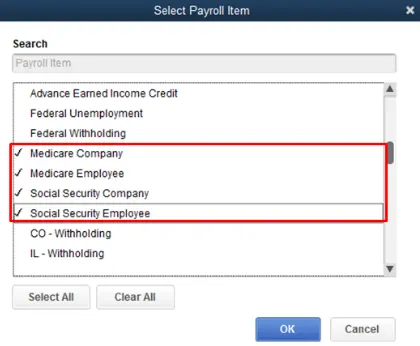

- At this point, go to the Filters tab, after which you should choose Payroll Item.

- Choose the Multiple Payroll Items option and mark the relevant taxes that have not been deducted.

- Tap OK and check whether the paychecks have precise deductions.

If the payroll item doesn’t have accurate deductions, instantly adjust the payroll liabilities as outlined below.

Step II: Carry Out Payroll Liabilities Adjustment

When you adjust payroll liabilities, you can remove tax discrepancies and ensure precise payroll item setup. Here’s how to do so:

- Open QuickBooks and choose the Employees tab.

- Go to the Payroll Taxes and Liabilities tab and click Adjust Payroll Liabilities. If you cannot find payroll liabilities, you should obtain it immediately.

- Utilize the Date and Effective Date options to choose the relevant paycheck.

- At this point, navigate to the Adjustment For section.

- Choose Employee Adjustment to modify the employee’s year-to-date (YTD) information.

- Move to Item Name and quickly choose the payroll item that you need to adjust.

- Type the amount for adjustment. You should enter a positive amount if the payroll item is under-withheld. Otherwise, type a negative amount.

- Go to the Income Subject to Tax tab and type the wage base adjustment amount.

- Access the Memo field and type a note for reference.

- Navigate to Accounts Affected and click OK.

- Choose the Affect Liability and Expense Accounts option.

- Tap OK, after which you can ensure proper tax deduction for each payroll item in the employee’s paycheck.

Are you still noticing QuickBooks payroll not deducting taxes? If that’s the case, repair the company file using the next solution.

6. Scan and Repair the Company File Data

You won’t be able to ensure prompt and precise tax deductions if the company file data is damaged. To resolve this, you have to run the Verify and Rebuild Data Utility. This utility will effectively repair your company file data, helping you ensure correct tax calculation through QB payroll.

If, however, you continue to observe QuickBooks payroll not deducting taxes, consider checking the employee’s tax calculation limit as outlined below.

7. Verify the Employee’s Tax Calculation Limit

QuickBooks payroll won’t calculate the employee’s taxes if the default limit has been reached. You need to review the employee’s tax details and modify the tax calculation limit. Here’s what you should do:

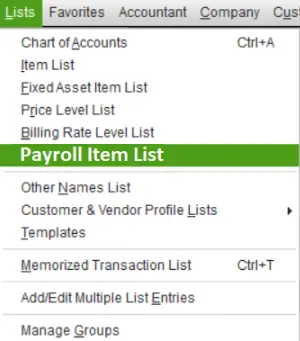

- Firstly, open QuickBooks Desktop and move to Lists.

- Choose Payroll Item List and right-click the relevant payroll item.

- Select Edit Payroll Items and tap Next until you get the Limit Type option.

- Now, make sure that you have selected the right option for your employee. You will find three different options: Annual – Restart Every Year, Monthly – Restart Every Month, and One-Time Limit.

- At this point, you can also change the default Limit Type for your employee.

- Finally, tap Finish on the window and reopen QuickBooks Desktop.

You should create paychecks for your employees and check if the payroll taxes are getting deducted. If you find QuickBooks payroll not deducting taxes even now, utilize the following resolution.

8. Review the Employee’s Payroll Tax Configuration

Taxes are calculated in QB payroll according to the payroll data that you enter for different employees. Some common factors that have an impact on the calculation of payroll taxes include taxable salary & wages, number of dependents, allowances, pay frequency, and the filing status. It is essential to ensure that these factors are correctly registered in the QB payroll. Here’s what you need to do:

- Open QB Desktop and access the Employees menu, and after that, you can go to the Employee Center.

- At this point, double-click the employee’s name and select Payroll Info.

- Check the Pay Frequency and move to the Taxes tab.

- Select the Federal option, and after that, you should review the Filing Status and Allowances. If required, you should make appropriate corrections in these fields.

- Tap OK to save your employee’s verified payroll setup. After that, you can generate the paycheck and seamlessly calculate payroll taxes.

Do you continue to find QuickBooks payroll not deducting taxes? If that’s the case, consider removing the duplicate payroll tax items as explained below.

9. Erase the Duplicate Payroll Tax Item

Duplicate payroll tax items can lead to incorrect tax deductions and distort payroll reports. In some cases, you might not even be able to deduct payroll taxes for your employees due to inconsistencies in the payroll data. Once you remove all the duplicate tax items, you can ensure the seamless calculation of payroll taxes. Here’s how to do so:

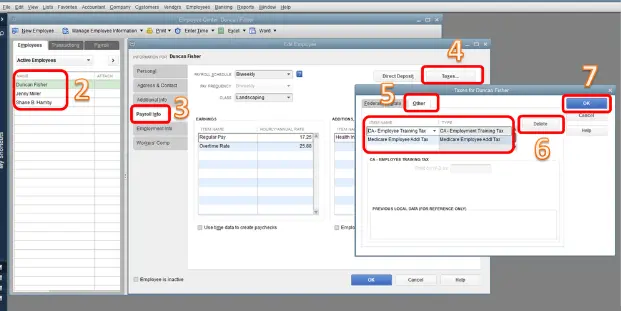

- Firstly, access QuickBooks and move to the Employees menu.

- Choose the Employee Center, and after that, you have to double-click your employee’s name.

- Select Payroll Info, and you will need to choose the Taxes option.

- At this point, select Other and locate the duplicate payroll tax item.

- Tap Delete to erase the duplicate payroll tax item, and after that, click OK to save the revised settings.

Finally, you can effortlessly create paychecks for your employees and ensure the precise deduction of payroll taxes.

Wrapping Up

In this extensive article, we walked you through various troubleshooting methods that you can utilize when you find QuickBooks payroll not deducting taxes. Hopefully, you can now effortlessly ensure accurate tax deductions for all your employees.

Common Queries On QB Desktop Payroll Taxes

Why is QuickBooks payroll not deducting taxes for my employees?

What should I do when QuickBooks doesn’t automatically deduct payroll taxes?

What should I do if I have already issued paychecks with faulty tax details?

Are there any best practices for ensuring accurate payroll tax deductions in QB Desktop?

a. Regularly download & install the latest payroll tax tables.

b. Verify your employees’ payroll information.

c. Remove discrepancies from various payroll accounts.

d. Install the latest QB Desktop updates.

e. Scan and repair your QB company data by running QuickBooks File Doctor.

Gabby Taylor, combines financial expertise with literary prowess. With over a decade in finance, she crafts insightful narratives on navigating fiscal complexities