QuickBooks Error PS038 occurs when payroll updates fail due to stuck paychecks or subscription-related issues. Many QB users have encountered this issue when trying to update paychecks or run payroll, and have spent their precious time and money to get their tasks back on track. If you are facing this frustrating hiccup, then you are not alone.

In this blog post, we will tell you about the best troubleshooting methods to address this error “QuickBooks unable to update payroll error PS038”, while also telling you about its meaning and causes.

Whether you have questions or need assistance regarding the QuickBooks error PS038 code in desktop, you can connect with our certified experts at +1(800) 780-3064 for quick and reliable solutions.

What Does The QuickBooks Payroll Error PS038 Mean?

The QuickBooks Desktop payroll update error PS038 does not come with any warnings and can occur when you are in the middle of running payroll. The PS038 is among the common errors in the PSXXX series and happens when the payroll you were sending was not in sync with the servers. In this error code, you may see the message “Online to Send”.

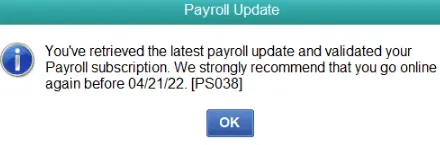

“You’ve retrieved the latest payroll update and validated your Payroll subscription. We strongly recommend that you go online again before mm/dd/yyyy. [PS038]”

This error message means that the QuickBooks software is stuck updating or processing previous payroll and cannot move forward because of the task being in a pending state.

Let’s dive into the article to discover common reasons behind this error and explore effective resolutions for it.

Why Do You Encounter QuickBooks Payroll Update Error PS038?

Here are the reasons behind QuickBooks error PS038:

- Sometimes, paychecks in QuickBooks get stuck as Online to Send. This is one of the major reasons behind this issue.

- Using an outdated version of QuickBooks Desktop.

- Damage in the QB company data.

- Restrictive settings of Windows Firewall.

- Expired QB payroll service subscription.

- Corruption in QuickBooks program.

Now that you understand various factors that give way to this QuickBooks payroll stuck Error PS038, let’s jump to the following section to find out detailed troubleshooting hacks for it.

13 Proven Methods to Resolve QuickBooks Error PS038 “Online to send.”

You can implement the troubleshooting methods described below whenever you face QuickBooks payroll error code PS038. Ensure that you utilize these resolutions in the exact order indicated below.

1. Install QuickBooks Updates & Send Payroll Data

You are likely to run into the QuickBooks PS038 payroll update problem if you are using an outdated version of QB Desktop. To fix this issue, you can update QB, and after that, try to send payroll data. Here’s what you can do:

Step I: Download & Install QB Desktop Application Updates

You should immediately download and install QB Desktop updates on your computer. This will enable you to utilize fresh features and technical functionalities while running your payroll operations. Once you have installed the latest QB updates, proceed to the next step.

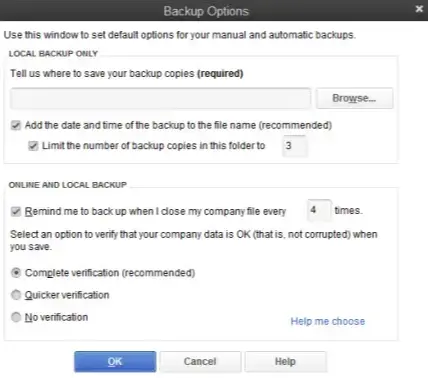

Step II: Create and Save a New Backup Company File

When you save a backup company file, you ensure additional security for your business data. Here’s what you need to do:

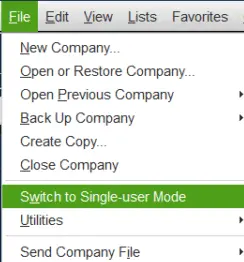

- In the QB window, go to File, and after that, tap Switch to Single-User Mode.

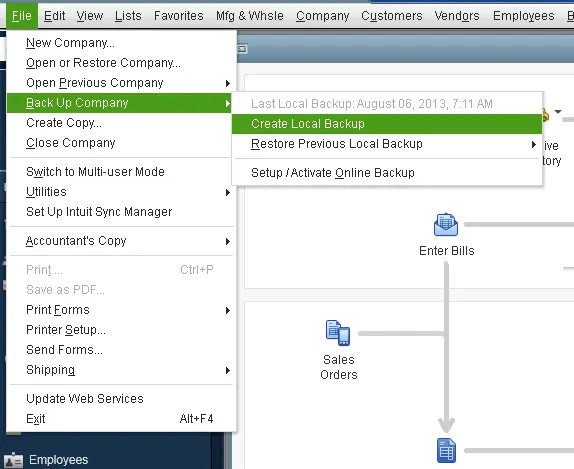

- Move back to File and hover over the Back Up Company tab. After that, you must tap the Create Local Backup option.

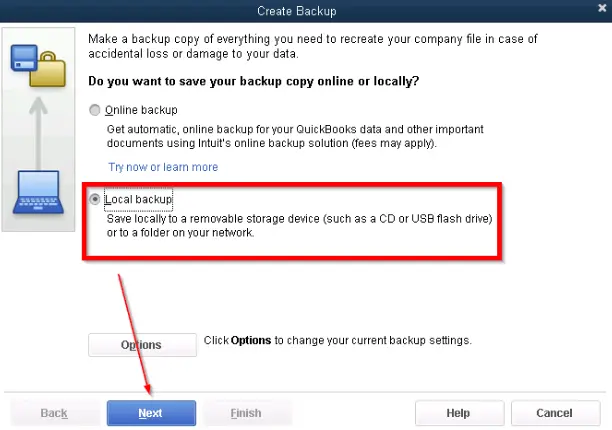

- Jump to the Local Backup tab, and you should click Next.

- Use the Browse option to select a folder, and after that, click OK.

- Finally, tap Save It Now to save the backup company file in the selected folder.

After saving the backup company data, scroll down to the next step and send your payroll data.

Step III: Send the Payroll Data or Usage Data

In this step, you should try to send payroll data to check your payroll service. Here’s what you should do:

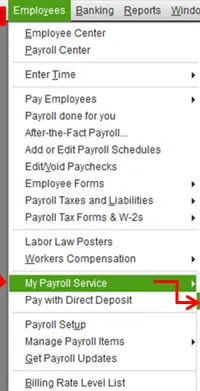

- Tap on Employees and choose My Payroll Service.

- Now tap on Send Usage Data. However, if you can’t find this option, open the Employees menu and choose Send Payroll Data.

- Now, when the Send/Receive Payroll Data window opens, choose Send All. If asked to, type the payroll service pin.

You should now attempt to download the latest payroll updates. If you are still facing QuickBooks error PS038, try the following solution.

2. Check Your Payroll Subscription Status

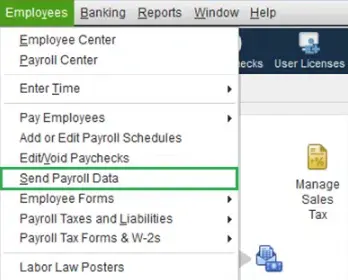

You need to make sure that your payroll subscription is active to avoid errors such as PS038 and QuickBooks error 05396 40000 during payroll setup. Here is how you can find the payroll subscription:

- Log in to the QB company file as Primary Admin or Payroll Admin.

- Go to Employees, followed by Payroll Center.

- Now, you will be able to see payroll service under Subscription Statuses in the Payroll tab.

- If the payroll service has expired, you will need to reactivate it by tapping the Reactivate option.

- Follow the steps that appear on the screen and make the necessary payment to re-subscribe to the payroll service.

Do you continue to encounter QuickBooks error PS038? If that’s the case, consider re-entering the payroll service key as detailed below.

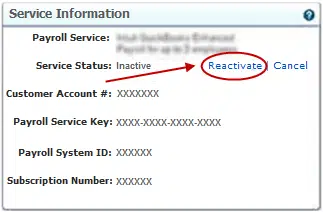

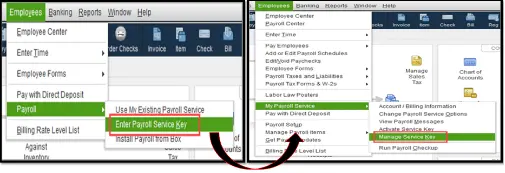

3. Re-enter the QB Payroll Service Key

If your payroll service key hasn’t expired and it still shows as inactive, you can re-enter the payroll service key. This will prompt QuickBooks to re-initiate the payroll service connection. Here’s what you should do:

- Tap on Employees and choose My Payroll Service.

- Select Manage Service Key.

- Locate the payroll service key and choose it.

- Tap on Remove and choose Add.

- Type in the active payroll service key.

- Now, click on Finish and OK.

Now, start QuickBooks Desktop and run the payroll operations again. If you still see the error PS038, continue to the next resolution.

4. Identify Stuck Paychecks & Rebuild Your Data

The QB payroll error can arise due to stuck paychecks in QuickBooks Desktop. You should identify stuck paychecks and rebuild your data. Here are the steps that you should follow:

Step I: Locate All the Stuck Paychecks

Here are the points that show how you can find out all the stuck paychecks:

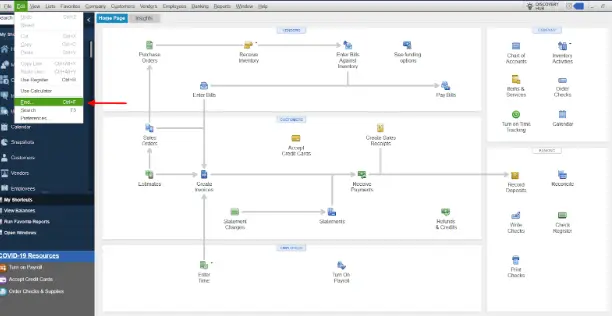

- Tap on Edit and choose Find.

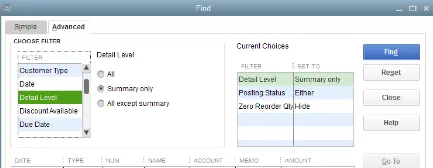

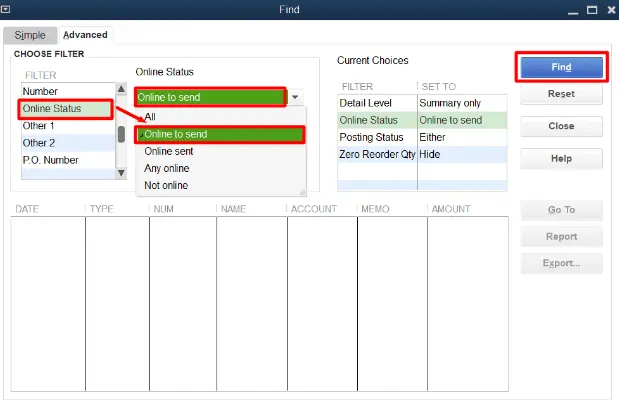

- Click on the Advanced tab.

- Now, go to the Choose Filter section.

- Tap on the Filter list and choose Detail Level.

- Click on Summary Only.

- Tap on the Filter list and scroll down to the Online Status.

- Choose Online to Send, followed by Find.

- Check which paychecks are stuck and haven’t been sent to Intuit. Note down the number of matches shown on the Find window.

Now that you have located stuck paychecks, let’s shift to the next step and rebuild the company file.

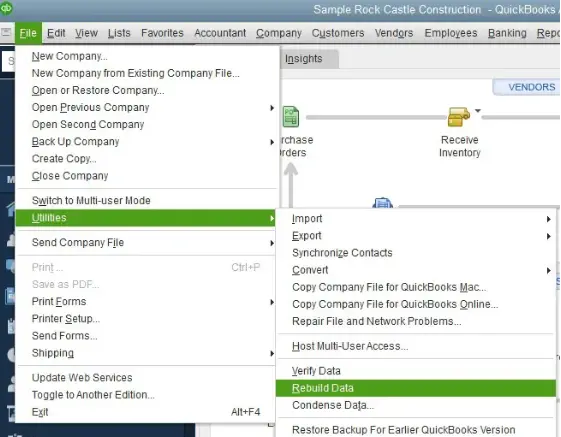

Step II: Run the Verify and Rebuild Data Tool

When you run the verify and rebuild data tool, you can effortlessly repair your company data. You will see all the stuck paychecks when you verify company data using this tool. Moreover, rebuilding your company data will resolve several internal issues.

You should now try to download and install payroll updates. If you continue to see the QB payroll error message PS038, consider toggling the paychecks as discussed below.

5. Toggle All the Stuck Paychecks

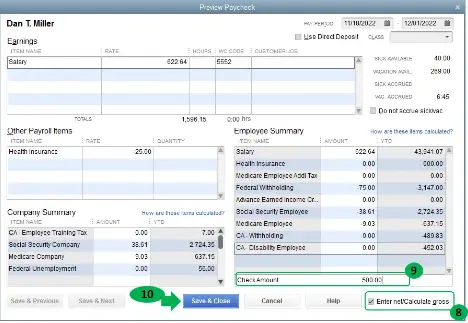

Stuck paychecks might be preventing you from updating your payroll. In the previous solution, when you verified the company data, you found stuck paychecks. You will toggle these stuck paychecks to resolve the payroll update error. Here’s what you must do:

- Open the oldest of the stuck paychecks you found earlier.

- Tap on Paycheck Detail.

- Go to the Review Paycheck window.

- In the Earnings section, find the last earnings item in the list. Add the same earnings item again. For instance, if you find that the last item in the list is Hourly Rate, add an earnings item named Hourly Rate again to the list.

- When you see the Net Pay Locked message, choose No.

- Check and verify that there are no changes to the tax amounts and net pay. Tap on OK.

- Click on Yes if a Past Transaction message appears.

- Now, tap on Save & Close. This will close the paycheck.

- If you see a Recording Transaction warning message, choose Yes.

- Now, open the same paycheck again and click on Paycheck Details.

- Go ahead and delete the earnings item you recently added.

- Check and verify that there are no changes to the tax amounts and net pay. Tap on OK.

Do the same for all the stuck paychecks present in your company file. Once you are done, re-attempt to download the payroll update. If you are still getting QuickBooks Desktop Payroll Error Code PS038, try updating Windows as detailed below.

6. Download the Latest Windows Updates

An outdated Windows operating system can interfere with the payroll update process, triggering different error codes. You should download and install Windows updates on your computer. Once you have done that, you can try updating QB payroll.

If, however, you still encounter QuickBooks update error PS038, consider checking your Internet connection as outlined below.

7. Check the Internet Connection Settings

You shouldn’t download payroll updates with an unstable or slow network connection; it will only run into errors. Therefore, check your internet connection before you run the payroll updates. Here’s what you need to do:

- Open any Internet speed test website, such as Cloudflare, and find the current Internet speed on your computer. If it is less than 10 Mbps, you should switch to a new Internet service provider that guarantees higher speed.

- It is also crucial to ensure that Internet setup devices are in perfect condition. If required, you should reconnect Internet setup devices, such as modem, router, network interface card, and Wi-Fi adapter to your system.

Do you encounter QuickBooks error PS038 even after verifying the Internet connection settings? If so, try renaming the CPS folder as described below.

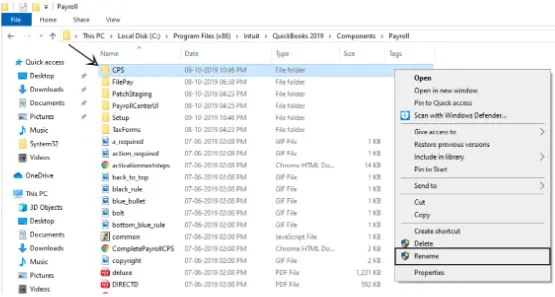

8. Rename the CPS Folder to Fix QuickBooks Error PS038

The CPS folder stores files that are utilized when you attempt to update payroll tax tables. If this folder is damaged, you won’t be able to install payroll updates. By renaming this folder, you can force QuickBooks to recreate it. Here’s how to do so:

- Exit QuickBooks and go to the following location: C:\Program Files\Intuit\QuickBooks 20XX\Components\Payroll\CPS

- Right-click the icon of the CPS folder and choose Rename. After that, assign a fresh name to the folder as per the following example: CPSNEWNAME

- At this point, you should open QB Desktop so that the CPS folder is recreated. After that, you can start running various QB payroll operations.

Do you still notice the QB payroll update error PS038 (cannot run payroll) ? If so, try reconfiguring Windows Firewall settings as discussed below.

9. Exclude QB Programs in Windows Firewall

Windows Firewall can disrupt payroll operations if it regards QB Desktop as a threat to the system security. You should exempt QB programs in Windows Firewall to address this issue. This will allow you to easily update payroll and send paychecks.

If, however, you still get the QB payroll error message PS038, try running Quick Fix my Program as explained below.

10. Create Exceptions For QB Program in Antivirus Software

The antivirus software installed on your computer might restrict the execution of QB programs. Consequently, you will face errors when downloading payroll updates and sending paychecks. To overcome this challenge, you should exclude QB programs in the antivirus app.

If, however, you continue to notice the PS038 error in QuickBooks, you should check the system date & time settings as described below.

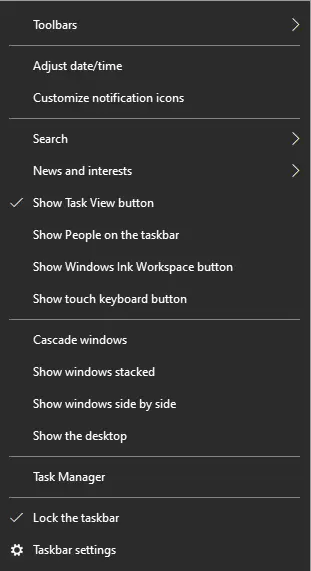

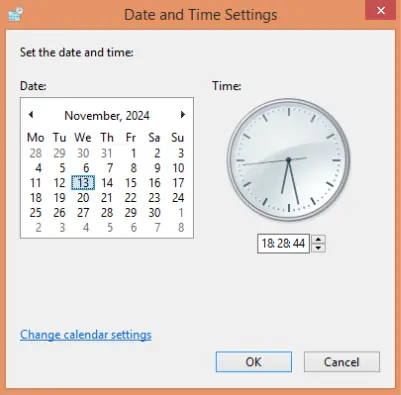

11. Verify the System Date and Time Settings

You won’t be able to download payroll updates if the system date and time settings are incorrect. To ensure a valid date and time on your computer, you should do the following:

- Firstly, you must right-click the date and time box shown at the bottom-right corner of Windows Desktop.

- Choose Adjust Date/Time and navigate to the Date and Time window.

- In the Date and Time window, you should click the Change Date and Time option.

- Move to the Date and Time Settings window and make suitable changes in the date and time settings.

- Once you have ensured the date and time are valid, tap OK and start QuickBooks Desktop to install payroll updates.

If you run into the PS038 error code in QuickBooks even now, try the following resolution.

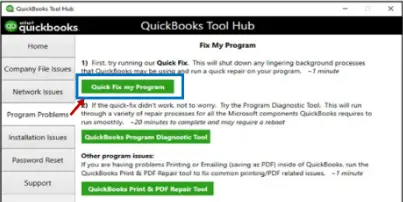

12. Use the Quick Fix my Program Tool to Repair the QB Program

Internal faults in the QB program can trigger various payroll errors. To fix these issues, you can run the Quick Fix my Program tool. Here’s how to do so:

- Firstly, you should ensure that QuickBooks Tool Hub is installed on your computer.

- Open QB Tool Hub by double-clicking its icon, and you should move to the Program Problems menu.

- Click Quick Fix my Program and allow the tool to run.

- Once the Quick Fix my Program tool has repaired your QB program, you can exit QB Tool Hub and start running QB payroll operations.

If you encounter QuickBooks error PS038 even after fixing your QB program, follow the next troubleshooting method.

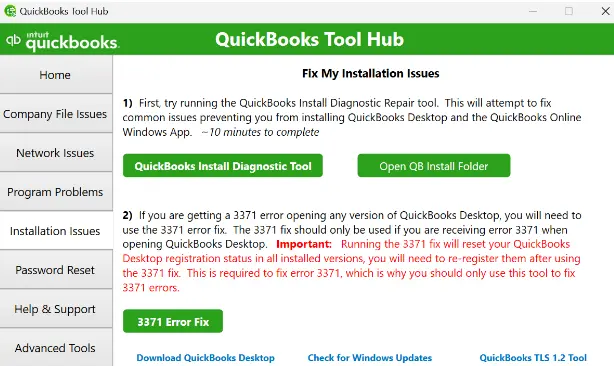

13. Operate the QB Install Diagnostic Tool

The QB Install Diagnostic Tool can help you resolve various installation problems on the QB Desktop. After running this tool, you will be able to download payroll updates and send paychecks. Here’s what you need to do:

- First and foremost, you need to download and install QuickBooks Tool Hub.

- You must double-click the icon of QB Tool Hub to open it and jump to the Installation Issues menu.

- Select QuickBooks Install Diagnostic Tool and allow it to run.

- Once the tool has repaired QB Desktop, exit QB Tool Hub and restart your computer.

Finally, you can successfully install QB payroll updates and send paychecks to Intuit. If you need to update the payroll bank account as well, do so before sending the paychecks.

To Conclude

With this blog post, when you cannot run payroll or stuck with paychecks, we aimed to help you solve the QuickBooks error PS038 in desktop with some easy solutions. Although solving this error code can be a headache, these troubleshooting methods should help you. Moreover, all the methods included are tried and tested and do not impose any kind of risk. In case the error is still persistent, it is recommended that you connect with a expert at +1(800) 780-3064 to address it.

Frequently Asked Questions (FAQs)

Q. What is QuickBooks Error PS038?

Q. How can I check if my payroll subscription is active?

Q. Can antivirus or firewall settings trigger PS038?

Gabby Taylor, combines financial expertise with literary prowess. With over a decade in finance, she crafts insightful narratives on navigating fiscal complexities