QuickBooks helps you to maintain the highest accuracy in all their records. Sometimes, however, discrepancies arise in invoices, requiring you to cancel them. In many cases, you may need to ensure QuickBooks void invoice from previous year.

Once you void an invoice, it is removed from your QB records. It does not affect your financial data. Furthermore, all the accounting entries related to the invoice are erased. Your financial data becomes well-organized, helping you effectively audit it in the future.

Let’s quickly explore this article to know how we can void various invoices in QuickBooks and learn relevant tips and considerations.

Learn When to Void an Invoice in QuickBooks Software

Here are the reasons that may prompt you to QuickBooks void invoice from previous year.

1. Inaccurate Amounts

You may need to void an invoice if you have issued it with incorrect amounts.

2. Duplicate Invoices

Sometimes, you may issue an invoice more than once, leading to double-counting and overbilling. When you void extra invoices, this issue gets resolved.

3. Credit Notes

You need to issue credit notes to your customers when you want to remove errors from invoices. Credit notes help you acknowledge the refund of an amount due to various reasons, such as damaged goods and overpayments. By voiding an invoice, you can easily sort out all these issues.

4. Returned Goods and Services

Customers can return goods and services for various reasons. Consequently, you may have to void invoices to maintain correct records.

5. Removing Accounting Errors

Various accounting errors in invoices can cause issues when you audit your financial records. All such errors can be fixed by voiding invoices from the relevant period.

Now that you know the different factors behind voiding invoices in QuickBooks, let’s move to the following section to examine certain considerations related to the voiding process.

Know This Before Canceling an Invoice in Another Fiscal Year

The implications of voiding an invoice in QuickBooks software can be far-reaching. Here are the major points that explain all the key considerations related to QuickBooks void invoice from previous year:

1. Impact On Financial Records

Voiding an invoice cancels the particular payment but keeps the invoice number in your QB reports. Hence, you need to ensure that voiding is justified as it affects your financial records. If you experience a QuickBooks delivery server down, you need to quickly fix that first. Moreover, there will be an impact on the audit trail, and you need to be aware of it before tracking financial activity.

2. Effect On Customer Relationships

You need to properly communicate to the customer, explaining all the reasons for voiding invoices. It is crucial that your customers understand all the reasons behind the voiding process.

3. Impact On Different Tax Amounts

The voiding of invoices can have tax implications if you have already reported your invoices to tax authorities. Once you have voided the invoice, you can consult a tax management professional to handle the relevant details. Furthermore, voiding an invoice can lead to non-compliance with government regulations related to tax statements.

4. Changes in Different Accounting Reports

Once you void an invoice, there are specific changes in financial reports. You have to verify and approve all the changes in various reports carefully. This will ensure that your business operations always utilize precise reports in different projects.

Now, let’s move to the following section to explore how to void invoices in QuickBooks software using reliable steps.

QuickBooks Void Invoice From Previous Year: Verified Steps

Here are the typical steps that you can utilize to ensure QuickBooks void invoice from the previous year.

We have made two different sections to void invoice from previous year in QuickBooks Desktop and QuickBooks Online.

1. For QuickBooks Desktop

Before implementing various steps for voiding invoices, you should install new QuickBooks Desktop updates. This will make sure that you can use newly developed tools and features. Furthermore, if you want to erase multiple transactions, you need to use the Batch Delete/Void Transactions Utility.

Now, utilize the following steps in the precise order:

Step I: Create a Backup Company File

Create and save a new backup company file to provide additional safety for your financial data. This will ensure that you can effortlessly void invoices. Here’s what you need to do:

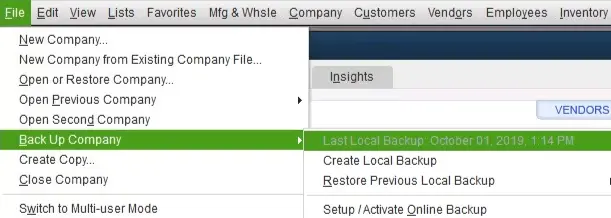

- Open QB Desktop and choose Back Up Company in File.

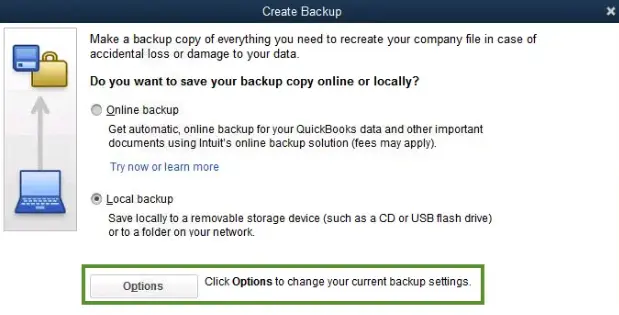

- Click Create Local Backup and choose Local Backup.

- Tap Next and choose Browse, which is located in the Local Backup Only section.

- Select the folder where you need to save the backup file.

- Tap OK and click the Save It Now button. The backup company file will be saved in the selected folder on your system.

Step II: Void an Invoice From Previous Fiscal Year

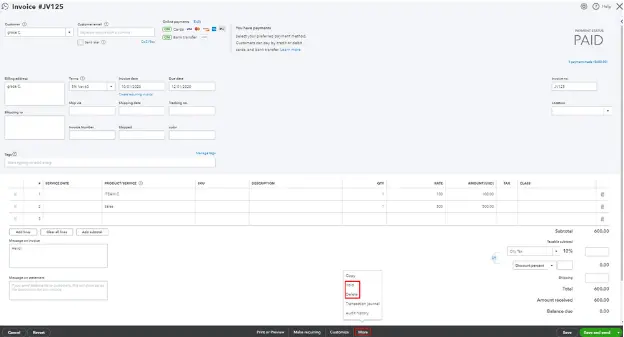

Here’s how you can effortlessly QuickBooks void invoice from previous year:

- Access QB Desktop and choose the Customers menu.

- Click Customer Center and tap Customers & Jobs.

- At this point, identify the name of the customer and the invoice that you want to void.

- Click Delete/Void and go to the Main tab.

- Choose the Delete drop-down arrow option, after which you should tap Void.

- Finally, you can tap the Save and Close button to confirm the invoice has been voided.

Now, let’s look at how we can void invoices in QB Online, as discussed below.

2. For QuickBooks Online

Here are the steps that can help you QuickBooks void invoice from previous year:

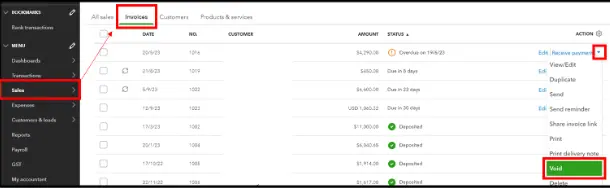

- Open your QB Online account and choose the Sales menu.

- Select Invoices, after which you should identify the relevant invoice from the previous financial year.

- Go to the Action column and click the drop-down icon.

- Tap Void and click Yes to confirm the voiding of the selected invoice.

- Finally, you have voided the chosen invoice in your QB Online account.

Let’s jump to the following section to understand the difference between voiding and deleting invoices.

Know When You Should Delete or Void QuickBooks Invoices

Sometimes, you may get confused about QuickBooks void invoice from previous year or delete invoices. You can explore the following interactive table to understand the main differences between deleting and voiding invoices:

| Relevant Feature | Voiding Invoices | Deleting Invoices |

| Aim | To cancel the invoice without permanent removal. | To permanently remove the invoice. |

| Effect On Accounts Receivables (ARs) | No effect. | Reduces ARs by the relevant amount. |

| Customer Records | The invoice is marked as voided in customer records. | The invoice is completely erased from the customer records. |

| Audit Trail Data | A record is present showing voided invoices. | No records are left in the audit trail data. |

| Reversibility | Yes. | No. |

| Best Use | To make changes in incorrect invoices. | For invoices that are totally invalid and cannot be modified. |

Summing Up

In this comprehensive technical guide, we have explored relevant steps regarding QuickBooks void invoice from previous year. Hopefully, you can now void every invoice in QB Desktop and QB Online.

Frequently Asked Questions (FAQs)

Q. Why would someone need to void an invoice from a previous year in QuickBooks?

Q. Is it safe to void a previous-year invoice in QuickBooks?

Q. What happens to financial reports when I void an invoice from a past year?

Gabby Taylor, combines financial expertise with literary prowess. With over a decade in finance, she crafts insightful narratives on navigating fiscal complexities