QuickBooks offers robust payroll and financial management features to small business owners. Sometimes, however, you might struggle with QuickBooks blocking catch up 401K contribution. As a result, several employees who want to make these additional contributions might feel confused and, as a result, even dissatisfied.

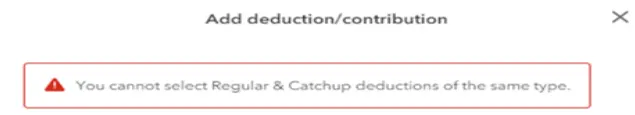

These following error messages could help you understand why is QuickBooks restricting the employee from making the catch up 401K contribution.

| You are going to go over the $7500 limit |

Or

Only knowing the root cause can help you troubleshoot this issue using effective tactics. Let’s explore this article to learn why we experience this problem and discover comprehensive solutions to it.

Why Do You Fail to Add QuickBooks 401K Contribution?

The following factors are behind QuickBooks blocking Catch Up 401K contribution:

- Imprecise employee profile settings.

- Obsolete version of QuickBooks.

- Heavy cache data in the browser application.

- Corrupted web browser.

- Setting up multiple 401K contributions.

- Contribution limit exceeded.

Now, let’s move to the following section to explore some really quick ways to fix this issue.

Instant Hacks to Resolve QuickBooks 401K Contribution Error

The following table presents different tactics that you can use when you find QuickBooks blocking catch up 401K contribution. Explore the table and successfully add the 401K contribution.

| Main Reasons | Effective Solutions |

| Obsolete version of QuickBooks. | Install QuickBooks updates. |

| Defective employee profile settings. | Reset the employee profile settings. |

| Heavy cache data in the web browser. | Erase the web browser cache and cookies. |

| Damaged web browser application. | Utilize a new web browser application. |

| Setting up multiple 401K contributions. | Remove the additional 401K contribution. |

Let’s jump to the next section to learn detailed troubleshooting methods for this issue.

Is QuickBooks Blocking Catch Up 401K Contribution?

Before implementing any solution for QuickBooks blocking catch up 401K contribution, you need to install the latest Windows updates. This will ensure that you have all the critical features and services for the smooth operation of QuickBooks.

We have listed verified resolutions for QuickBooks Desktop and QuickBooks Online in separate sections. To implement the troubleshooting hacks, go to the relevant section described below.

Section A: QuickBooks Desktop Blocking Catch Up 401K Contribution

Here are the solutions that you can use if you cannot add the 401K contribution in QB Desktop.

1. Install the Latest QuickBooks Desktop Updates

You might experience failure when adding catch up 401K contribution if you use an outdated version of QuickBooks Desktop. To fix this, you have to effectively download and install the latest QuickBooks updates on your system. This will equip you with all the necessary tools, features, and bug fixes for making 401K contribution.

If you still find QuickBooks blocking catch up 401K contribution, try the next troubleshooting technique.

2. Enable the Catch Up 401K Contribution For Your Employee

QuickBooks will automatically block the employee from making the catch up 401K contribution if the relevant option is not enabled in the payroll settings. Here’s how you can enable catch up 401K contribution settings for your employee:

- Open QB Desktop and select the Lists tab.

- Choose Payroll Item List and go to the Payroll Item tab.

- Select New and choose Custom Setup. After that, tap Next and go to Deduction or Company Contribution.

- Choose the name of the deduction (or company matching item) and tap Next.

- At this point, choose the name of your retirement plan provider. After that, select the account to track deductions.

- Go to the Tax Tracking Type window to choose the 401K retirement plan.

- Next, you have to choose Neither for the Calculate Based On Quantity option.

- Tap Finish and move to the Employee Center in the Employees menu.

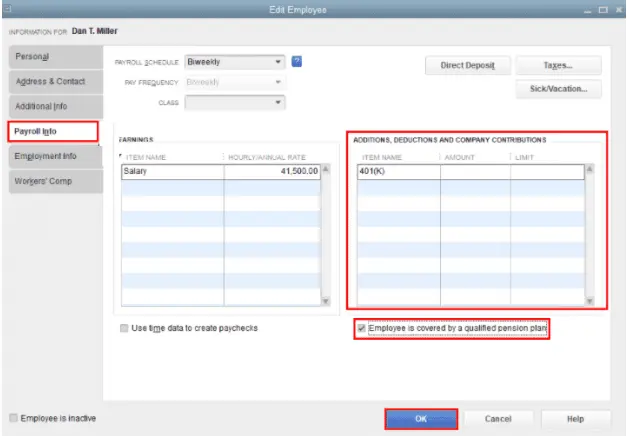

- Choose your employee’s name and go to Payroll Info.

- Now, add the 401K contribution plan under the Additions, Deductions, and Company Contributions section.

- Type the amount, and after that, you need to click OK.

Do you still find QuickBooks blocking catch up 401K contribution? If so, consider ensuring a single 401K contribution as discussed below.

3. Set a Single Deduction For 401K Contribution

When you set up the 401K contribution plan for your employees, you need to ensure only one deduction per 401K contribution. Therefore, having multiple 401K deductions will trigger errors when you try to add the catch up contribution. You will need to erase the 401K contribution that you have already set up. Here’s how you can do it:

- Access your QB Desktop application to select Employees.

- Now, choose the Employee Center, after which you need to select the employee’s name.

- At this point, go to Payroll Info and choose the deduction amount.

- Next, select the 401K contribution item name and hit Delete.

- Click OK to save the modified payroll settings.

Do you still notice QuickBooks blocking catch up 401K contribution? If so, consider checking the 401K contribution limit as explained below.

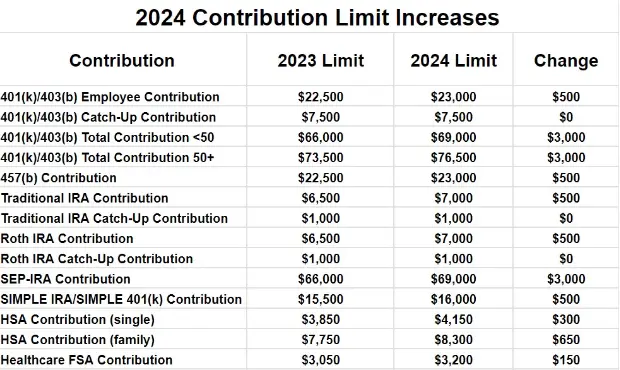

4. Review the 401K Contribution Limit

QuickBooks will block you from making a 401K contribution if you exceed the IRS contribution limit. Therefore, you need to make sure that your total annual contribution (including standard and catch up contributions) does not exceed the limit set by the IRS.

The IRS revises the contribution limit every year. Therefore, it is essential to check the official 401K contribution limit regularly.

Section B: QuickBooks Online Blocking Catch Up 401K Contribution

Below are the troubleshooting methods that you should utilize when you fail to add the catch up 401K contribution in QB Online (QBO).

1. Activate the 401K Contribution Option in QBO Payroll

Your employee won’t be able to add the catch up 401K contribution if the appropriate option is disabled in QB Online Payroll. Here’s how to activate the 401K contribution option in QBO Payroll:

- Access QB Online and choose Payroll. After that, you should select the Employees tab.

- Now, you have to choose the employee’s name and select Deductions & Contributions.

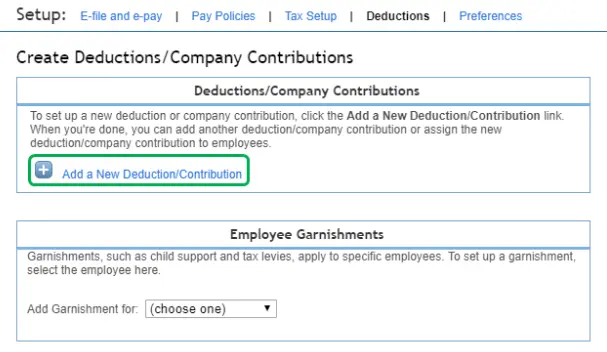

- Click +Add Deduction/Contribution and choose Retirement Plans.

- At this point, go to the Deduction/Contribution Type tab.

- Choose the 401K Catch Up option and enter the relevant amount.

- You can select Company Contribution to enable the company match.

- Finally, tap Save, after which the employee will be able to contribute 401K for retirement.

Do you continue to find QuickBooks blocking catch up 401K contribution? If that’s the case, consider ensuring that you have included only one 401K deduction as discussed below.

2. Enable Only One Deduction Per 401K Contribution

It is important to ensure only one deduction in the 401K contribution plan for your employees. You should remove the extra 401K contribution that you might have included in QuickBooks Online Payroll. Here’s how you can do so:

- Firstly, open QB Online to choose Payroll.

- Now, go to Employees, after which you need to select the employee’s name.

- Move to Deductions & Contributions and select 401K.

- Tap the Trash Bin icon to erase the selected deduction.

- Finally, tap Save, after which you need to click Done.

If you still notice QuickBooks blocking catch up 401K contribution, try running your browser in incognito mode as detailed below.

3. Use Your Web Browser in Incognito Mode If You Find QuickBooks Blocking Catch Up 401K Contribution

The accumulation of heavy cache and cookies data in the browser can affect access to QuickBooks Online. As a result, you might fail when adding the catch up 401K contribution. To fix this, you can access QB Online by running your browser in incognito mode. Here’s the table that depicts various shortcuts to run different browsers in incognito mode:

| Web Browser | Shortcut Keys |

| Google Chrome | Ctrl + Shift + N |

| Mozilla Firefox | Ctrl + Shift + P |

| Safari | Command + Shift + N |

Do you continue to discover QuickBooks blocking catch up 401K contribution? If that’s the case, consider using a new browser as outlined below.

4. Utilize a New Web Browser Application

QuickBooks Online (QBO) can be easily accessed using several web browser applications. The following table illustrates various web browsers that you can utilize to access QBO on both web and mobile devices:

| Web Browser | Recommended Version |

| Google Chrome | 78 or Newer |

| Opera | 68 or Newer |

| Microsoft Edge | 79 or Newer |

| Samsung | 10 or Newer |

| Mozilla Firefox | 76 or Newer |

| Safari | 12 or Newer (Mac Only) |

Once you start using a new web browser, you will effortlessly add the catch up 401K contribution for each employee.

Wrapping Up

In this detailed guide, we have learned verified resolutions that you can implement when you find QuickBooks blocking catch up 401K contribution. Hopefully, you can now set the catch-up 401K contribution for each employee. If, however, you still experience numerous challenges or have a query, you should contact a QB professional for reliable guidance.

Common Queries On QB Catch Up 401K Contribution

Why do I find QuickBooks blocking catch-up 401K contributions?

What should I do when QB blocks the adding of catch up 401K contribution?

What precautions can I take to ensure the seamless adding of catch up 401K contribution?

Gabby Taylor, combines financial expertise with literary prowess. With over a decade in finance, she crafts insightful narratives on navigating fiscal complexities