When creating paychecks, you might find QuickBooks payroll not calculating taxes or not doing so correctly. This immediately prompts you to halt your payroll operations. After all, calculating and withholding payroll taxes from employees’ paychecks and submitting them to SSA is one of the crucial things that you can’t overlook.

Here are some common issues that you might face when creating paychecks:

- The calculated sum of payroll taxes is invalid.

- Different tax components are absent on the employee’s paycheck.

- The total federal or state income tax withheld from the employee’s paycheck is $0.00.

The silver lining is that you can troubleshoot this problem through simple methods. Let us explore what factors give way to this complication and the methods we can utilize to resolve it effectively.

Why Has QB Desktop Stopped Calculating Payroll Taxes?

Here are some common reasons why QuickBooks might have stopped calculating payroll taxes.

- If you have not updated QB Desktop, it might have become incompatible with Windows, and thus, several errors can arise when calculating taxes.

- The employee’s total earnings might have exceeded the wage base limit for the specific tax.

- Invalid setup of payroll items, tax, or employees in QuickBooks Desktop can cause authentication-related problems when creating paychecks.

- The gross wages of the employee are too low to calculate tax.

- If you are still using older payroll tax tables, you won’t be able to calculate valid taxes for your employees when generating different paychecks.

- Corruption in the company data is another major factor that can trigger internal problems when you run QB payroll.

- Duplicate payroll tax items can lead to overcalculation of payroll taxes for your employees, potentially leading to various errors.

- The imprecise payroll tax calculation limit for the employee won’t enable you to calculate taxes.

- Discrepancies in payroll liabilities can provoke different errors when running QB payroll.

Now that you know various reasons behind QuickBooks not calculating payroll taxes, let’s dive deep into and explore relevant troubleshooting methods.

9 Things to Do If QuickBooks Payroll Not Calculating Taxes

Here are the expert-recommended solutions to run when you find QuickBooks payroll not deducting taxes. However, remember to carry them out in the order they are given.

1. Install QuickBooks Desktop Updates

The first thing to do is download and install the latest updates for QuickBooks. The software updates come with better performance, bug fixes, and new features. This might often resolve common issues in QuickBooks.

Once you have updated QB Desktop, create the paychecks and check if the payroll taxes are getting calculated. If you still find QuickBooks payroll not calculating taxes, consider using the next resolution.

2. Download & Install QB Payroll Tax Table Updates

You need to install the latest QB payroll tax table updates. This is important before running payroll operations.

Payroll updates come with revised tax rates and performance enhancement. However, if you find the QuickBooks payroll update not working, you will need to fix that first.

Once you have updated your QuickBooks Desktop and payroll, check if QB is calculating payroll taxes now. If you continue to find QuickBooks payroll not calculating taxes, try refreshing your employee’s payroll info as detailed below.

3. Refresh Your Employee’s Payroll Information

Outdated tax rates, salary status, and deductions affect how tax is calculated in your QB Desktop payroll. Therefore, you should promptly refresh your employee’s payroll information as follows:

(a) When You Are Still Generating the Paycheck

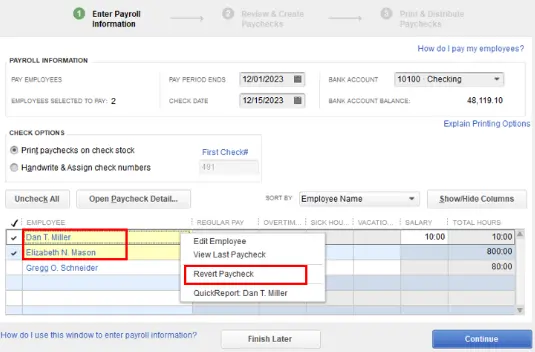

You should revert the employee’s paycheck if you are still generating it. Once you have done that, all the payroll data will be refreshed, and taxes will be calculated precisely. Here are the steps that explain how you can revert the paycheck:

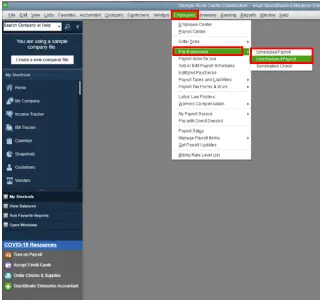

- Open QB Desktop and promptly choose the Employees menu.

- Select the Pay Employees tab, after which you must tap Scheduled Payroll.

- Now, choose Resume Scheduled Payroll and immediately right-click the name of the relevant employee.

- At this point, tap the Revert Paychecks button.

- The paycheck will be refreshed with the correct tax details.

(b) When You Have Already Issued the Paycheck

If you have already generated the employee’s paycheck, you need to delete or void it using the following steps:

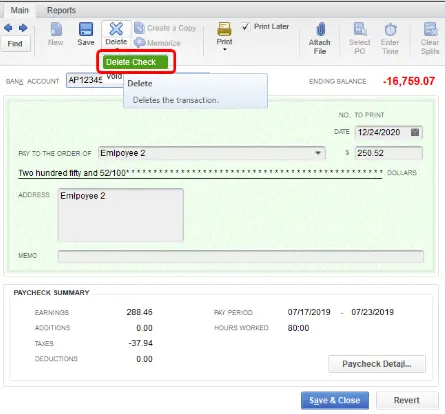

Case 1: You Haven’t Sent the Paycheck to Intuit

You should delete the paycheck using the following steps if you haven’t sent it to Intuit:

- Access QuickBooks Desktop and choose the Banking menu.

- Click Use Register and immediately select your bank account.

- Tap OK, after which you need to open the relevant employee’s paycheck.

- Click the Delete button on the paycheck window.

- Finally, tap OK to confirm the deletion of the paycheck. After that, you can successfully generate a fresh paycheck with correct tax data.

Case 2: You Have Sent the Paycheck to Intuit

Here are the steps to void the paycheck that you have sent to Intuit:

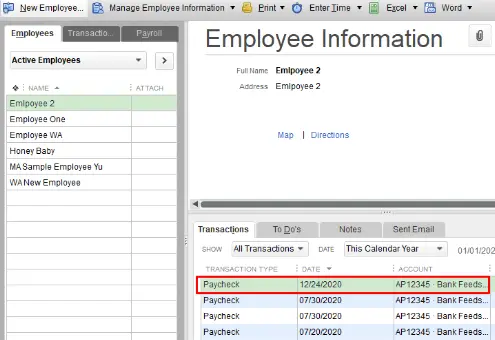

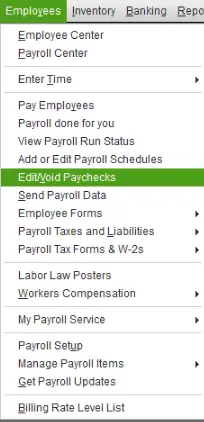

- Open QB Desktop, after which you need to select Employees.

- Now, choose the Edit/Void Paychecks tab on the window.

- At this point, click the Show paychecks through/from option so that you can choose the relevant dates for your paycheck.

- Hit Tab on your keyboard, and after that, you should select the relevant paycheck icon.

- Tap Void and type YES, after which you should choose Void.

- Mark the appropriate checkbox to accept all the terms and conditions.

- Finally, tap OK to void the selected paycheck. After that, you can start creating a fresh paycheck with all the relevant tax details.

Is QuickBooks payroll not calculating taxes even now? If you find that’s the case, try the next solution.

4. Review the Employee’s Tax Withholding Status

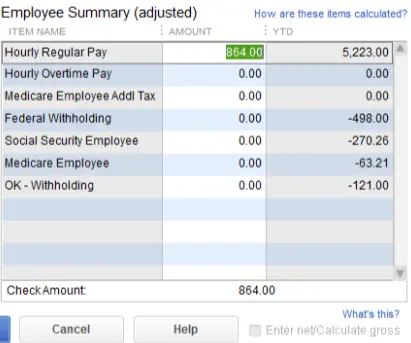

Your employee’s federal or state taxes can appear as $0.00 on the paycheck if your employee claims exemption. Furthermore, taxes can appear as $0.00 if the employee doesn’t receive enough salary to meet the minimum threshold.

We need to check that if you find QuickBooks payroll not calculating taxes. To know the minimum threshold for tax withholding, you can explore the official IRS publication and check out your state tax department website.

When you notice that the employee should not receive tax exemption, you can change the tax filing status as follows:

- Open QB Desktop, choose Employees, and then click Employee Center.

- Choose the employee’s name and go to the Payroll Info tab.

- Now, choose Taxes, after which you need to select the Federal tab.

- At this point, use the W-4 form menu to select the appropriate form.

- Select the Filing Status tab, after which you will need to choose the Not Exempt option.

- Move to the State tab and select the Filing Status tab.

- Choose Not Exempt, after which you should tap OK.

- Finally, you can create the employee’s paycheck with proper tax details. If you face problems finding the payroll tax liabilities in the Payroll Center, you need to resolve that instantly.

If QuickBooks fails to calculate payroll taxes, consider reviewing the employee’s payroll setup as explained below.

5. Check the Employee’s Payroll Tax Setup

Taxes are calculated based on the payroll data that you enter in QB Desktop. Here are some key factors that influence the calculation of payroll taxes:

- Taxable Salary.

- Number of allowances and dependents.

- Pay frequency.

- Filing status setup.

You need to review all these factors in the employee’s payroll tax setup. Here’s how to do so:

- Swiftly open QB Desktop and choose the Employees menu.

- Go to the Employee Center and double-click the name of the relevant employee.

- At this point, choose Payroll Info and verify the Pay Frequency.

- Select the Taxes option, after which you must choose the Federal tab.

- Verify the Filing Status and Allowances. If required, make necessary corrections in the relevant fields.

- Tap OK to save the verified payroll tax setup of the employee.

- Finally, recreate the employee’s paycheck with the correct tax details. If you find QuickBooks payroll check transactions do not match, you should fix that immediately.

If you find QuickBooks not calculating payroll taxes even after verifying the employee’s payroll tax setup, let us repair the QB company file as described below.

6. Operate the Verify and Rebuild Data Utility

QB Desktop maintains a comprehensive record of payroll tax data in the company file. This data is highly crucial for payroll tax calculation, payroll processing, and compliance. If this data is corrupted, you won’t be able to ensure proper tax calculation for your employees.

The Verify and Rebuild Data utility can effectively repair the company file that stores payroll tax data. Therefore, verify and rebuild your company file if you find QuickBooks payroll not calculating taxes. You can successfully recreate the employee’s paycheck with precise tax details.

If, however, you continue to find QuickBooks payroll not calculating taxes, try checking the tax calculation limit as described below.

7. Review the Employee’s Tax Calculation Limit If Payroll Not Calculating Taxes

QuickBooks payroll won’t calculate taxes if you have incorrectly chosen the employee’s annual or monthly tax calculation limit. To ensure the flawless calculation of taxes, you should enter the right amount for the tax calculation limit. Here’s what you must do:

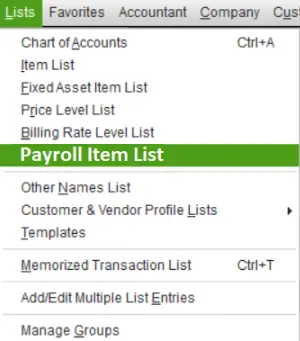

- Open QuickBooks, and after that, go to the Lists menu and select the Payroll Item List tab.

- Right-click the payroll item that you want to modify, and after that, you must choose Edit Payroll Items.

- At this point, scroll down to the Limit Type section on the window.

- Review the employee’s tax calculation limit that you have selected. If you want to change the limit, you should revise the amount shown on the window.

- Access the Limit Type tab and ensure that you have selected the right option.

- Annual – Restart Every Year

- Monthly – Restart Every Month

- One-Time Limit

- Finally, tap Finish to save your updated settings. After that, check if QB Desktop withholds the employee’s taxes.

Do you still find QuickBooks payroll not calculating taxes? If so, try erasing the duplicate payroll tax item as explained below.

8. Remove the Duplicate Payroll Tax Item

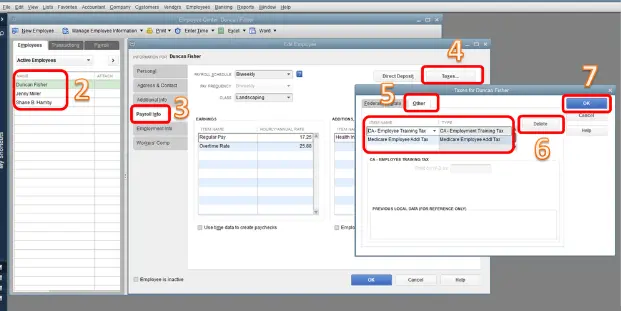

If there are duplicate payroll tax items for an employee, you won’t be able to ensure the precise calculation of taxes, potentially leading to several errors. Here’s how to erase duplicate payroll tax items:

- Open QB Desktop and jump to the Employees menu.

- Select Employee Center, and after that, double-click the relevant employee’s name.

- Click Payroll Info and choose Taxes, and after that, you have to tap the Other option.

- Identify the duplicate payroll tax item and click Delete.

- Tap OK and reopen QB Desktop to successfully create paychecks for your employees with the correct calculation of payroll taxes.

Is QuickBooks payroll not calculating taxes even now? If that’s the case, consider adjusting the payroll liabilities as detailed below.

9. Modify the Payroll Liabilities in the QB Desktop Application

Payroll liabilities represent the tax amounts owed to the federal & state governments from your employee’s paychecks. If these liabilities are incorrect, the calculated tax amounts will also be wrong. Furthermore, you might even experience failure when creating the employee’s paychecks. To resolve this problem, you should carry out the payroll liabilities adjustment. Here are the steps that you must follow:

Step I: Generate a Payroll Summary Report

The payroll summary report provides you with an overview of your employee’s taxes and contributions. It can help you identify discrepancies in various payroll tax items. Here’s how to create this report:

- Open QB and move to the Reports menu to select Employees and Payroll.

- Click Payroll Summary and select the appropriate date range.

- Use the Show Columns menu to choose the Employee tab.

- Tap Customize Report, and after that, go to the Filters tab.

- Navigate to the Choose Filter section, and after that, select the employee via the Name dropdown menu.

- Click OK to generate the payroll summary report.

Review the payroll summary report and identify the payroll items that require adjustment. Once done, proceed to the next step.

Step II: Adjust the QuickBooks Desktop Payroll Liabilities

When you adjust the payroll liabilities, you can remove different discrepancies in the payroll tax items, ensuring the smooth & flawless calculation of payroll taxes for your employees. Here are the points that you need to follow:

- First & foremost, select the Employees menu in QB Desktop & choose Payroll Taxes and Liabilities.

- Click Adjust Payroll Liabilities and choose the paycheck by selecting the relevant options in the Date and Effective Date fields.

- Select Employee Adjustment to modify your employee’s YTD (Year to Date) information.

- Go to Item Name and choose the payroll item that you want to adjust.

- Type the amount of the payroll tax item adjustment. You should increase or decrease the tax item amount depending on whether it is currently under-withheld or over-withheld.

- At this point, you should include the amount in the Income Subject to Tax column if you need to register the wage base adjustment.

- Utilize the Memo option to make a note for the tax item adjustment.

- Go to Accounts Affected and tap OK. After that, you can select either of the following options:

- Choose Do Not Affect Accounts to ensure that the balances remain unaltered for the liability & expense accounts in QB payroll.

- Choose Affect Liability and Expense Accounts if you want the adjustment to show up in the liability & expense accounts.

- Tap OK to save the changes, and after that, choose Next Adjustment to enter adjustments for more employees.

- Once you have adjusted payroll liabilities for all employees, click OK to finish the process.

Finally, you can reopen QB Desktop and seamlessly create your employees’ paychecks with the valid calculation of various payroll taxes.

Winding Up

In this elaborate guide, we have discussed various troubleshooting methods that you can implement whenever you find QuickBooks payroll not calculating taxes. Hopefully, you can now seamlessly create paychecks and calculate taxes for all your employees.

If, however, you are still encountering various problems or have a query, you should connect with a QB professional. They are available round the clock and will help you resolve QuickBooks issues in no time!

Frequently Asked Questions (FAQs)

Why is QuickBooks payroll not calculating taxes on my system?

You will notice QuickBooks payroll does not calculate taxes if the employee’s pay is too low to meet the required threshold. Additionally, the federal taxes won’t be calculated if the employee has too many dependents and if the company data is damaged.

How do I fix tax calculation errors in QuickBooks payroll?

Here are a few things that you can do to resolve tax calculation problems in QB Desktop payroll:

a. Ensure that the employee’s payroll information is accurate.

b. Install the latest payroll tax table updates.

c. Examine the tax setup and ensure that various tax deductions & contributions are appropriately configured.

d. Download & install QB updates.

e. Repair your company data using QuickBooks File Doctor.

f. Run the payroll summary report and carry out the payroll liabilities adjustment.

Are payroll reports affected by QuickBooks payroll not calculating taxes?

Yes, invalid tax calculations can trigger problems in various payroll reports, such as payroll summary reports and payroll tax liability reports. Furthermore, imprecise tax calculations can cause difficulties when auditing the business’s financial data.

Gabby Taylor, combines financial expertise with literary prowess. With over a decade in finance, she crafts insightful narratives on navigating fiscal complexities