Every business needs to ensure compliance with tax laws. One of the crucial steps in achieving perfect compliance with all the relevant tax laws is to update payroll tax tables in QuickBooks. This requires precise paycheck calculations, which is only possible with the help of the latest tax tables.

Updating payroll tax tables has certain other benefits, such as helping you during the audit process of your business’s financial data. Another advantage of fresh payroll tax tables is that you can boost employee satisfaction through faster paycheck calculation and disbursal.

It is easy to download and install new payroll tax tables in QuickBooks. Let’s dive into the guide to learn the simple steps to acquire fresh payroll tax tables and explore how to fix common payroll tax table update problems.

Easy Steps to Update Payroll Tax Tables in QuickBooks Desktop & Online

The following points explain how you can promptly update payroll tax tables in QuickBooks.

(a) For QuickBooks Desktop Payroll

Before installing new payroll tax tables, you need to ensure that you have an active QB Desktop payroll subscription. Here’s how to do so:

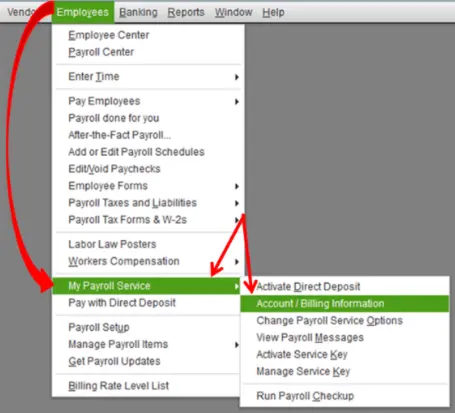

- Firstly, you have to access your QB Desktop company file, after which you should choose Employees.

- Tap the My Payroll Service icon and quickly click the Account/Billing Information option.

- At this point, access your Intuit account and review the Status menu.

- If you find Status as Active, it means you have an active payroll subscription. Otherwise, you need to renew your payroll subscription immediately.

Once you have an active payroll subscription, you can promptly acquire new payroll tax tables through the following steps:

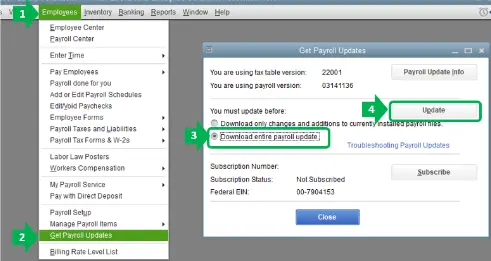

- Open your QuickBooks Desktop application and select the Employees menu.

- Now, choose My Payroll Service, after which you should click the Tax Table Information option.

- Note the first three digits under the You are using tax table version section. This is your current payroll tax table version.

- If you don’t have 11934004 as your current payroll tax table (2024 version), you will need to download fresh tax table updates.

- Move back to Employees and immediately click the Get Payroll Updates tab.

- Choose the Download Entire Update option, after which you should click Update to begin the download process.

- You will receive a confirmation message when the download of fresh payroll tax table updates is complete.

(b) For QuickBooks Online Payroll

Payroll tax tables for QB Online payroll are automatically updated. Therefore, you don’t need to follow any update process.

Note: You won’t be able to obtain the SUI (State Unemployment Insurance) rate when downloading new payroll tax table updates.

Here’s how you can update your SUI rates successfully:

(a) For QB Desktop Payroll

- Open the QB Desktop window and choose the Lists menu.

- Now, select the Payroll Item List tab, after which you need to double-click the [your state abbreviation here] – Unemployment Company option.

- Tap Next until you obtain the Company Tax Rates window.

- Type the valid rates for each quarter, after which you should click Next.

- Finally, you should tap Finish on the window.

If you have any surcharges or assessment rates for state unemployment, follow the process detailed below to update them:

- Move to the Lists menu in QB Desktop, after which you should choose Payroll Item List.

- At this point, double-click the State Surcharge icon and click Next.

- Follow each step until you get the Company Tax Rate window.

- Finally, type the required surcharges or assessment rates, after which you should click Finish. If you still find QuickBooks payroll not deducting taxes, you need to resolve it quickly.

(b) For QB Online Payroll

- Firstly, open your QB Online account and choose Settings.

- Click the Payroll Settings tab, after which you should choose Edit next to the name of your state.

- Go to the State Unemployment Insurance (SUI) section.

- Click the Change or Add New Rate option, after which you can type the new rate. Additionally, you can type the effective date for the new rate.

- At this point, type any additional assessment rates or surcharges.

- Finally, click OK to save the updated rates.

Sometimes, you can run into different errors, such as QuickBooks error 15103, when updating QB payroll tax tables. Let’s navigate to the following section to discover what you can do to resolve such error codes.

Recommended Ways to Fix QB Payroll Tax Table Update Issues

As stated previously, you can encounter different error codes, such as payroll error 30001, when trying to update payroll tax tables in QuickBooks. To resolve such errors, you can implement the following solutions in the precise order:

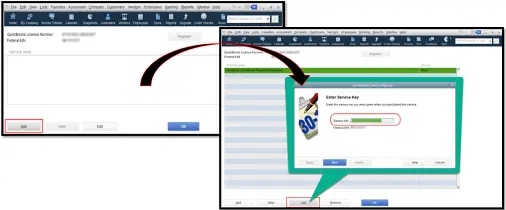

1. Re-enter the QB Payroll Service Key

The QB payroll service key is a unique 16-digit code that helps you activate the payroll service. You need to re-enter this key if you find the payroll update not working.

Here’s how you should re-enter the payroll service key:

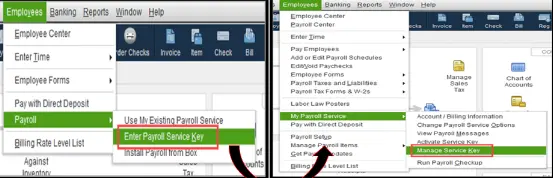

- Firstly, you should open the QB Desktop and immediately choose Employees.

- Choose the My Payroll Service tab and swiftly tap the Manage Service Key option.

- At this point, you need to click Edit so that you can re-enter the payroll service key.

- Tap Next and promptly unmark the Open Payroll Setup checkbox.

- In the final step, you should tap Finish to install fresh payroll updates and save the payroll service key.

Are you still not able to update payroll tax tables in QuickBooks? If that’s the case, consider updating QB Desktop as described below.

2. Install Fresh QB Desktop Application Updates

New QB Desktop application updates include all the latest security and software improvements. Therefore, you should swiftly download QB Desktop updates on your computer. You will be able to effortlessly acquire new payroll tax table updates once you have fresh QB updates. If you cannot find your financial data after updating QuickBooks, you can recover it instantly.

At this point, if you cannot install payroll tax table updates even now, you can repair the QB program as detailed below.

3. Run the Quick Fix my Program Tool

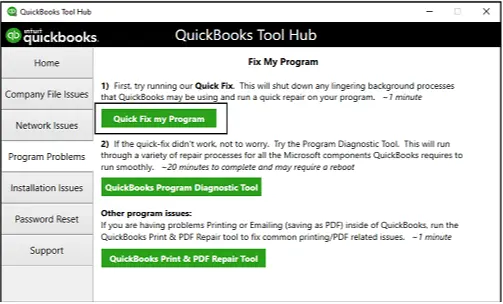

Technical faults in the QuickBooks program setup can restrict the download of new payroll tax table updates. Here’s how you can run Quick Fix my Program to remove all such technical faults:

- Access your browser and swiftly download and install the most recent edition of QuickBooks Tool Hub.

- At this point, quickly double-click the QuickBooks Tool Hub icon to open up the QuickBooks Tool Hub window.

- Now, you need to choose Program Problems, after which you can run the Quick Fix my Program tool.

- Finally, the QB program will be repaired, allowing you to update payroll tax tables.

If you have failed to update payroll tax tables in QuickBooks even now, try the following troubleshooting method.

4. Reconfigure the Windows Firewall Setup

Inaccurate settings of Windows Firewall can block the download of new QB payroll tax table updates. You need to reset the Windows Firewall settings to provide an exemption to QB programs. After that, you can successfully download fresh payroll tax table updates.

Are you still failing to update payroll tax tables in QuickBooks? If so, consider fixing your QB company file, as discussed below.

5. Repair Your QB Desktop Company File Data

Corruption in your QB company file data can trigger errors when updating payroll tax tables. You need to promptly utilize the verify and rebuild data utility to resolve all issues in the company file data.

If you encounter an unrecoverable error code when trying to run the verify and rebuild data utility, you should fix it immediately. Once you have repaired the company file data, you can effectively update payroll tax tables.

Summing Up

In this extensive guide, we showed you how you can seamlessly update payroll tax tables in QuickBooks. Furthermore, we have discussed how you can resolve common problems that might occur while doing so.

Hopefully, you can now effortlessly download & install QB payroll tax table updates. However, if you are still facing technical challenges or have a query, you can connect with an experienced QB professional for real-time guidance.

Frequently Asked Questions (FAQs)

A. Updating payroll tax tables in QuickBooks Desktop means downloading the latest federal and state tax rates used for payroll calculations. These updates ensure employee deductions such as Social Security, Medicare, and income taxes are calculated accurately. If the payroll tax table is outdated, paychecks may show incorrect tax amounts. Updating the table regularly keeps your payroll compliant with current government regulations and helps avoid payroll filing errors.

A. Keeping payroll tax tables updated in QuickBooks ensures that employee taxes are calculated using the latest tax laws. Governments frequently adjust withholding rates, wage limits, and other payroll rules. Without updates, businesses risk miscalculating payroll taxes, which could lead to penalties or rejected filings. Updating the tax table keeps your payroll system reliable and compliant.

A. Payroll tax tables should be updated whenever Intuit releases a new update. Most businesses check for updates at least once every month or before running payroll. Intuit regularly releases tax table updates when there are changes to federal or state payroll regulations. Running the update before processing payroll helps ensure accurate tax deductions.

A. To manually update the payroll tax tables in QuickBooks Desktop, open the program and go to Employees > Get Payroll Updates. Then select Download Entire Update and click Update. Once the download finishes, QuickBooks will confirm that the new tax table has been installed. After that, you can run payroll using the updated tax rates.

A. If payroll tax tables are not updated in QuickBooks Payroll, employee tax deductions may be incorrect. This can result in under-withholding or over-withholding of payroll taxes. Inaccurate tax calculations may also affect payroll reports and tax filings. Over time, outdated payroll tables can create accounting discrepancies that require manual corrections.

Gabby Taylor, combines financial expertise with literary prowess. With over a decade in finance, she crafts insightful narratives on navigating fiscal complexities