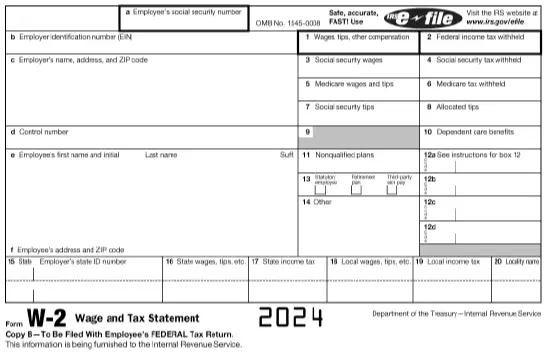

Have you filed incorrect W2 form in QuickBooks? This can lead to several problems both for you and your employees, such as IRS penalties, delayed tax refunds, longer audit processes, and invalid tax returns.

In some cases, QuickBooks can generate an incorrect W2 form, preventing you from finishing tax-related tasks accurately.

Well, there is a way to fix that. In this blog, we are going to guide you on how to correct the W2 forms in different QB products, such as:

- QuickBooks Desktop Payroll Basic, QuickBooks Desktop Payroll Standard

- QuickBooks Desktop Payroll Assisted

- QuickBooks Desktop Payroll Enhanced

- QuickBooks Online Payroll

Let’s quickly explore the whole article to learn the easiest steps through which we can generate and file correct W2 forms in QuickBooks.

Why Do You File Incorrect W-2s in QuickBooks Application?

You are likely to file incorrect W-2 forms in QuickBooks due to the following reasons:

- Entering invalid employee information, such as names, personal addresses, social security numbers, etc.

- Invalid payroll settings, such as pay details, tax tables, and deductions.

- Failure to update employee information regularly in QB payroll.

- Compatibility issues linked with the integration of third-party apps in QuickBooks.

Now that you know about various factors behind faulty W-2 forms in QB, let’s jump to the next section to learn proven troubleshooting hacks for it.

Do This If You Have Filed Incorrect W2 Form in QuickBooks

Here, you will find proven methods to utilize if you have filed incorrect W2 form in QuickBooks. These methods are classified according to the type of QuickBooks payroll product, viz., Basic, Standard, Enhanced, Assisted, and Online.

You can go to the relevant section and immediately implement the troubleshooting steps described there in the correct order.

Section A: Correct W-2 in QB Desktop Payroll Basic, QB Desktop Payroll Standard

You can always correct the W-2s and W-3 before you file them. However, if you filed incorrect W2 form in QuickBooks Desktop, there is a way to fix it.

If you use Payroll Basic or Payroll Standard in QB Desktop, you will need to create and file W-2C with SSA manually to correct the W-2. While doing so, check the general instructions for W-2c and W-3c forms.

Section B: Correct W-2 in QuickBooks Desktop Payroll Enhanced

Let us see how to correct W-2 forms in QB Desktop Payroll Enhanced before or after filing the W-2s.

1. If You Detect Mistakes Before Filing W-2 Forms in QB

If you find mistakes in the W-2, you can correct them before you file it. The errors in W-2 arise because of issues with your QuickBooks products or how the taxes are set. Therefore, resolve that and file the W-2s formally.

2. If You Find Mistakes After Filing W-2s in QuickBooks

If you have filed incorrect W-2s, you must create W-2c and W-3c in QuickBooks to resolve that. After that, print them on perforated paper only (not pre-printed).

Now, you must manually file W-2c and W-3c with the SSA (Social Security Administration). Here are the steps that you should follow:

- Open QB Desktop and tap on the Employees menu.

- Choose Payroll Center and click on the File Forms tab.

- Now, choose Annual Form W-2c/W-3c – Corrected Wage and Tax Statement.

- Tap on Create Form.

- Now, choose the employee’s last name and tap on OK.

- Locate the employee for whom you want to correct the W-2s by filing a W-2.

- Tap on Review/Edit.

- You will see the question: Have you made the W-2 corrections in QuickBooks Desktop? Answer it.

a. If your answer is Yes

The current QuickBooks Desktop information is in the Correct information column on the W-2c. Provide the Previously Reported amount for the items that you need to correct.

b. If your answer is No

The current QuickBooks Desktop information is in the Previously Reported column on the W-2c. You must check each W-2c worksheet and provide the correct amounts in the Correct Information column.

- Now, check each page, and when required, tap on Next.

- Mark the Check if this is a W-2c (corrected W-2) box.

- Enter ONLY the fields that must be fixed in the Previously Reported and Correct Information columns. You will need to do this for federal, state, and local information as required.

- Take the amounts out of the remaining lines. Right-click on the amounts, choose Override and then delete them. You will need to do this for Federal, State, and local information as required.

Once done, file the W-2c and W-3 manually with the Social Security Administration (SSA).

Section C: Correct W-2 in QuickBooks Desktop Payroll Assisted

If you use QuickBooks Desktop Payroll Assisted, you will need to contact the Intuit support team to correct a W2 form. The team will correct the mistakes and file the W-2 with the Social Security Administration (SSA). You will receive the W-2c that you can give to your employees and an updated W-3 copy to include in the official records.

However, know that there are some things that can’t be corrected in a W2, such as:

- Business Name

- Business address

- Employee prefixes (Mr., Mrs., etc.)

- Employee address

Section D: How to Correct a W2 in QuickBooks Online Payroll

In this section, we will show you how to correct a W-2 in QuickBooks Online before or after filing it. The instructions will vary depending on whether you use automated taxes and forms in QuickBooks or file them manually. Here are the points that you need to follow:

1. If Automated Taxes and Filing is Enabled

If automated taxes and forms features are enabled, the incorrect W-2 form in QuickBooks will be caused by your automated taxes and form settings. In that case, you can follow these points:

a. Fields You Can’t Change

If you use automated taxes and forms and you find QuickBooks has filed incorrect W-2 forms for you, there are a few things you can’t fix. These are:

- Employee prefixes (Mr., Mrs., etc.)

- Business Name

- Business address

- Employee address

If these details were filed correctly, let us proceed to correct the W-2s that were filed incorrectly.

b. How to Correct W-2 in QuickBooks Online

If you have enabled automated taxes and forms features, QuickBooks files the W2s and W3s for you. In this case, if you spot errors in the W-2s, you will need to contact Intuit, who will resolve the issue and file a W-2C form with the SSA (Social Security Administration). Subsequently, you will be sent a copy of the W-2C, which you should provide your employees, and an updated W-3 for your business records.

2. If Automated Taxes and Filing is Turned Off

If you have turned off the automated taxes and filing feature and find a mistake in the W-2s that you haven’t filed yet, here’s what you can do.

a. Before You File the W-2s in QBO Payroll

First, correct the mistake in the W-2 forms that QuickBooks generated. Check certain things that can affect the missing info in box 14. It could be because:

- The information in the employee’s profile or payroll settings is missing or incomplete.

- The company offers health insurance and other benefits, but the required data is not correctly set up.

- The errors in payroll settings, like incorrect pay periods, pay frequencies, or schedules.

After you have corrected the W2, go on to file them as you generally would.

b. If You Have Already Filed an Incorrect W-2 in QB Online Payroll

If you have filed incorrect W2 form in QuickBooks, you need to manually create the correct W-2 and W-3 forms. When you do so, make sure to follow the instructions for W-2c and W-3c forms.

Once done, you will be able to submit valid W-2 forms through QB Online payroll to SSA.

3. Learn How to Do Some Common W-2 Corrections in QB Online

Let’s look at how you can perform some common W-2 corrections in QB Online:

a. Correcting the Employee’s Name or Social Security Number (SSN)

Here’s how you can edit the employee’s name or SSN in QBO:

- Move to Workers, and after that, you should select Employees.

- Choose the employee whose data you want to correct.

- Tap Edit Employee and fill out the valid SSN and name in the relevant fields.

- Save the changes, and if you have already filed W-2s, you can follow the steps related to post-filing corrections.

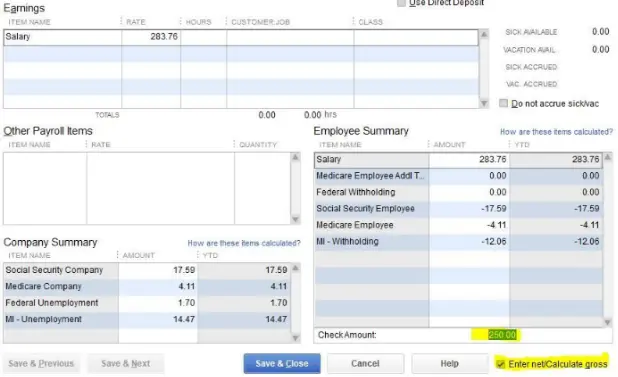

b. Editing the Wage or Tax Withholding Amounts

You can adjust the wages and tax withholding amounts through the following points:

- Jump to the Payroll menu and choose the Employees tab.

- Select the employee and tap the Paycheck List.

- Choose the paycheck and click More. After that, tap the Void option.

- At this point, create a fresh paycheck, and if required, type the year-to-date (YTD) amounts. You can do so by using the Pay Adjustment option.

- Run the payroll reports to verify all the updates.

- Finally, if you have filed W-2s, you can follow relevant steps for post-filing corrections.

c. Modifying the Retirement Plan Contributions

Here are the steps that you should follow to update the retirement plan contribution amounts:

- Access the Payroll menu, and after that, choose the Employees tab.

- Select the employee and tap the Pay Adjustment option.

- Now, type the correct retirement plan contribution amount in the field.

- Run the payroll reports to verify all the updates.

- You can follow the relevant steps for post-filing adjustments if you have already submitted W-2s.

4. Fixing Some Common Issues When Correcting W-2s in QB Online

Sometimes, you might experience problems when correcting W-2s in the QBO payroll. Here are various solutions that you can implement for all such problems:

a. Not Able to Edit Various Fields

Many fields are locked in QuickBooks Online at the time of year-end closing. Therefore, you will need to connect with the Intuit support team to edit specific fields.

b. Mismatch Between QB Records and Actual Payments

When you note that QB records and actual payments don’t match, you can do the following:

- Check all the bank statements and payroll records to discover the source of the discrepancy.

- Use the Pay Adjustment feature to modify the records in QB Online.

- If you find the pay adjustment process too complex, consider engaging a professional accountant for guidance.

c. Multiple Corrections Required Spanning Different Pay Periods

If you need to do multiple corrections across several pay periods for your employees, you can adopt the following approach:

- Assess the importance of errors and prioritize the corrections based on that.

- Form a checklist to make sure that you include all the corrections across all pay periods.

- Halt the automatic tax filing during the correction process.

Once you follow the points stated above, you can effortlessly ensure correct W-2s in QuickBooks Online.

Summing Up

In this exhaustive article, we showed you what you should do if you have filed incorrect W2 form in QuickBooks. Hopefully, you can now make sure that you submit the correct W2 forms to SSA. If, however, you continue to face challenges or have a query, you need to connect with a QB professional for real-time assistance.

Frequently Asked Questions (FAQs)

A. If you filed an incorrect W2 form in QuickBooks, the impact depends on the type of error. Mistakes in employee name, Social Security Number, or tax amounts can lead to IRS notices, employee confusion, and potential penalties. You must correct the error using a W-2c (Corrected Wage and Tax Statement) form.

A. No, once a W2 is submitted to the SSA or IRS through QuickBooks, you cannot directly edit it. You need to create and file a W-2c form to correct any mistakes. The correction process depends on whether you use QuickBooks Desktop Payroll or QuickBooks Online Payroll.

A. Yes. If you filed an incorrect W2 form in QuickBooks, notify the affected employee immediately. Provide them with a corrected W-2c form once processed. Transparency helps avoid confusion during tax filing season.

A. Penalties may apply if the correction is delayed. The IRS generally reduces penalties if errors are corrected promptly. Filing a W-2c as soon as the mistake is discovered minimizes risks.

A. You cannot void a W2 once it has been submitted to the Social Security Administration. Instead, you must issue a corrected W-2c form to amend the inaccurate information.

Gabby Taylor, combines financial expertise with literary prowess. With over a decade in finance, she crafts insightful narratives on navigating fiscal complexities